Required Materials:

- Books.

- Fixed Income Markets: and Their Derivatives, 2nd edition , by Suresh Sundaresan.

- Fixed Income Securities: Tools for Today's Markets, 2nd edition , by Bruce Tuckman.

- I expect you to subscribe to The Wall Street Journal and read it daily.

- The Economist is also recommended reading.

Philosophy of the course:

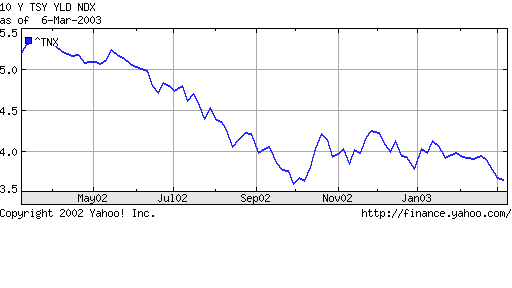

Here is a chart of the yield-to-maturity on the 10-Year US T-Note over the past two years:

- After 7 successive increases in the target Federal Funds rate, spanning June 30, 1999 through May 16, 2000 (as the target increased from 4.75% to 6.5%, the Federal Reserve Open Market Commitee has reduced this target 11 times in 2001 to 1.75% and then again by 50 basis points to 1.25% on November 6, 2002 (where it stands on March 7, 2003).

- Over the last two years, the yield on the 10-Year US T-Note has fluctuated wildly

from day to day, and has participated in the drop in the short rate, as it has

fallen from around 4.75% to its current level of 3.66%.

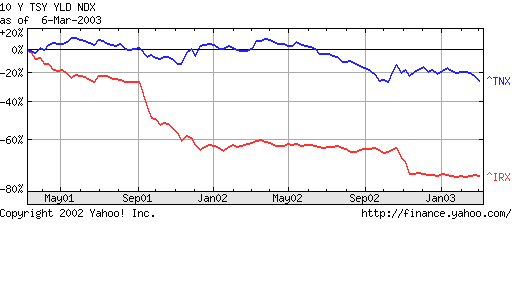

During this period, the yield on 90-Day US T-Bills has fallen even more

dramatically (from 4.5% to 1.1%) as seen on the following graph:

- Thus the yield curve has steepened fairly dramatically over this period. Historically, this marked difference between short and long rates is a harbinger of expectations of economic growth. The picture is muddied now by the bursting of the internet bubble in the US Stock market, the historically high valuations of US equities, and the extremely high volatility in the value of US stocks.

- While Corporate Bonds also performed well in 2001, they have underperformed US Government Notes by over 300 basis points in 2002. Since March, 2002, Corporates have been hit with growing concerns about credit risk.

This course is designed to introduce students to fixed income portfolio management. The course objective is to provide students with a set of tools to analyze fixed income markets.

This course is complementary to several other courses in our Finance curriculum. Specifically:

- FIN 523A and 523B -- Applied Portfolio Management. FIN 523 includes both an equity component (approx. $660,000), and a fixed income portfolio (approx. $3 million). Students involved with the fixed income component must take this class. In Applied Portfolio Management, you put to work the skills and tools developed in this class.

- FIN 521 -- Investment Analysis. FIN 521 provides a framework for understanding risk and return in financial markets.

- FIN 522 -- Derivatives. FIN 522 develops more deeply students' ability to evaluate derivative securities. The emphasis in FIN 522 is on equity derivatives. We will also look at sophisticated models of derivative valuation--on fixed income securities.

- FIN 512 -- Corporate Finance. All courses in Corporate Finance touch on the financing decision of financial managers to varying degrees. A clear understanding of conditions in debt markets is important in understanding and measuring the relative costs of debt and equity financing.

Conduct of Course and Grading:

There will be a problem set due each week (beginning week 2). Each problem set is worth 7 points. These may be done in groups of no more than three students. There will be a 2-hour final exam on the last class worth 30 points. The remaining 21 points will be based on your contributions to our class discussions, and the quality of your weekly market briefings and class discussions.

You are responsible for reading the material that is indicated on the course schedule, each week.

Tue Mar 4 21:57:25 MST 2003